Wages Under Employment Act Malaysia

Under the Minimum Wages Order 2016 effective 1 July 2016 the minimum wage is RM1000 a month Peninsular Malaysia and RM920 a month East Malaysia and Labuan. The minimum wage may be revised on a.

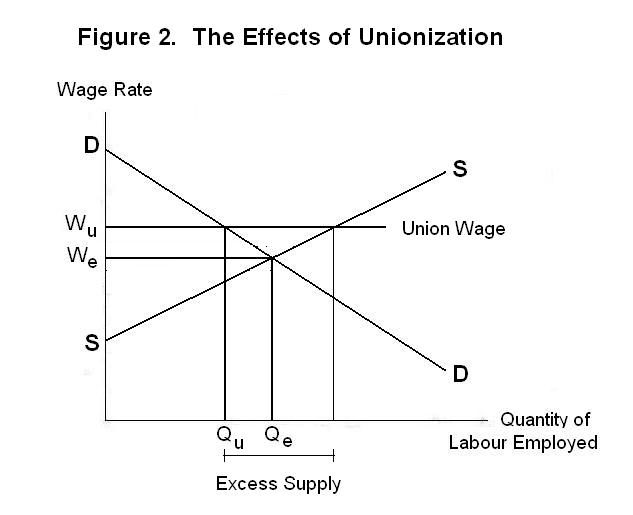

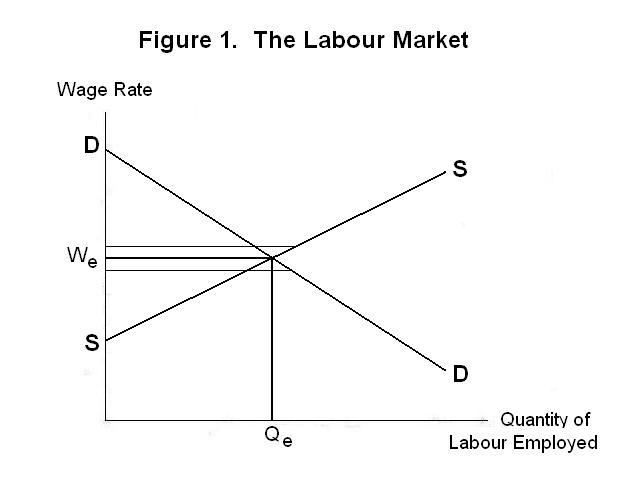

Wage Rates And The Supply And Demand For Labour

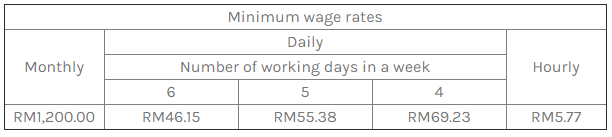

Under the new Order the payable rates for the new minimum wage for employees who work in a place of employment at the abovementioned areas are as follows.

Wages under employment act malaysia. Employees who are 55 years and above and earning wages not exceeding RM5000 will also benefit from the revised rate as their employers are now required to contribute at 65 per cent which is an additional 05 per cent from the current 6 per cent while. For more details on the minimum wage please read our previous article here. However in the event the Employee.

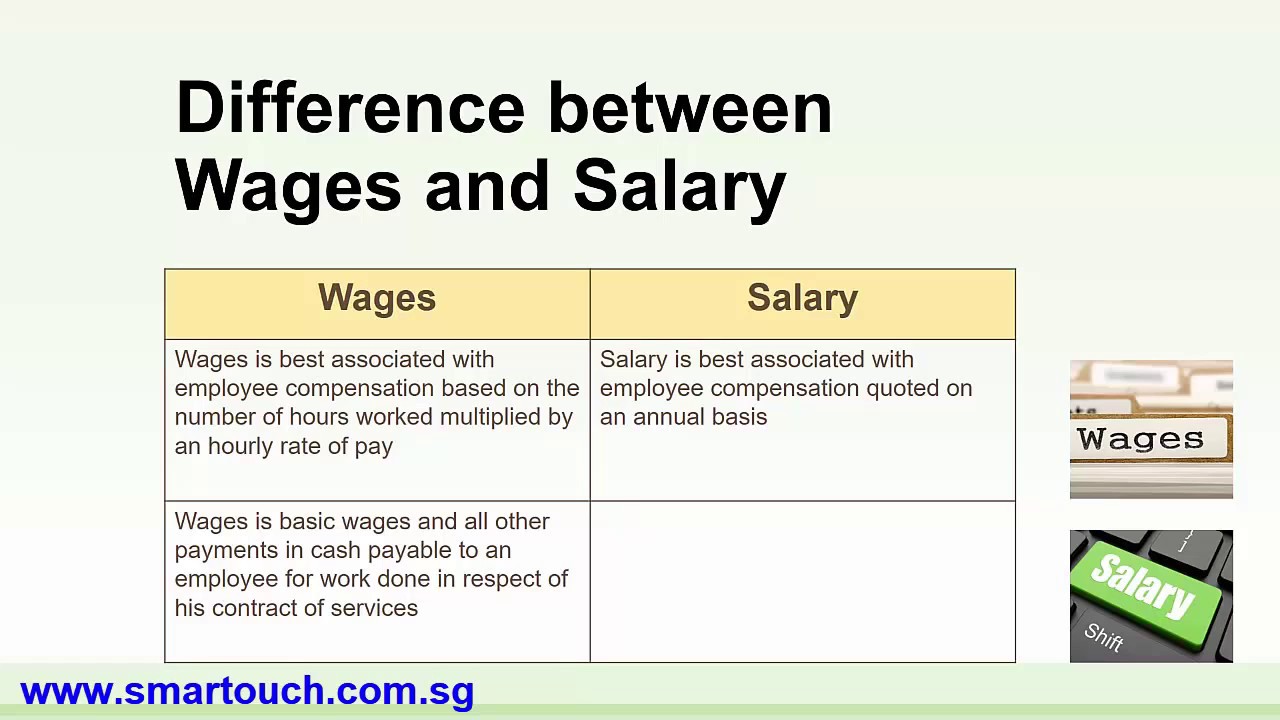

Pursuant to S25 1 of the Employment Act the employer must pay the employees wages through bank. Wages are defined under the Employment Act 1955 as basic wages and all other payments in cash payable to an employee for work done in respect of his contract of service. Overtime hours are worked on a voluntary basis and workers.

All workers are paid a wage equal to or exceeding the legal minimum wage. What are the required statutory deductions from an employees salary. The employee is covered under the Employment Act if they perform manual labour in any one wage period that exceeds 50 of the total time in which they are required to work in such wage period.

Under the Minimum Wages Order. This act covers only West Malaysia based on wages wages will not include commissions substince allowance and overtime payment and this must be RM2000- or less. The Minister may by regulations made under this Act provide that every employer or any specified class or classes of employers shall make available in such form and at such intervals as may be prescribed to every employee employed by him or them or to such class or classes of employees as may be specified such particulars as may be specified relating to the wages of such employees or any of them.

Under the Minimum Wages Order 2016 effective 1 July 2016 the minimum wage is RM1000 a month Peninsular Malaysia and RM920 a month East Malaysia and Labuan. Additionally SOCSO Social Security Organisation also known as PERKESO Pertubuhan Keselamatan Sosial contribution is a mandatory requirement imposed on all Employees irrespective of the Employees monthly wages. This Order prescribes the minimum wage payable to employees as being 1100 ringgit per month or 529 ringgit per hour for employees in Malaysia.

The national minimum wage will be MYR900 per month for employees in Peninsular Malaysia. While employees in Sabah Sarawak and the Labuan Federal Territory will be entitled to a minimum of MYR800. All workers including workers paid piece rate do not work more than national legal maximum hours.

According to Regulation 6 of the Employment Termination and Lay-Off Benefits Regulations 1980 employees whose monthly salary is RM2000 and below and who falls within the purview of the Employment Act 1955 EA 1955 must be entitled to retrenchment benefits as stated below depending on their tenure of employment-. Working Hours Wages Malaysia Wages meet legal requirements or national norms as a minimum. Working hours meet legal requirements and are not excessive.

Effective 1 January 2019 the minimum wages for employees in Malaysia is RM 1100. MINIMUM WAGES IN MALAYSIA AS OF 2020 Introduction On 11 October 2019 during the tabling of Budget 2020 Finance Minister Lim Guan Eng had announced. The Employment Act in Malaysia covers individuals under the description of employee and is defined under in the First Schedule Section 2 1 of the Employment Act 1955 and is summarized as follows.

An Employer is bound to make contributions to the Employees Provident Fund EPF for any individual under the Contract of Service. Otherwise a letter of consent to request the employer to pay via cash should be. What are the required statutory deductions from an employees salary.

Employee whose wages exceed RM2000 a month but provided under paragraph 2 of the First Schedule of the Employment Act- B 1 Employee engaged in manual labour. For more details on the minimum wage please read our previous article here.

Employment Act 1955 Malaysia Employment Acting Malaysia

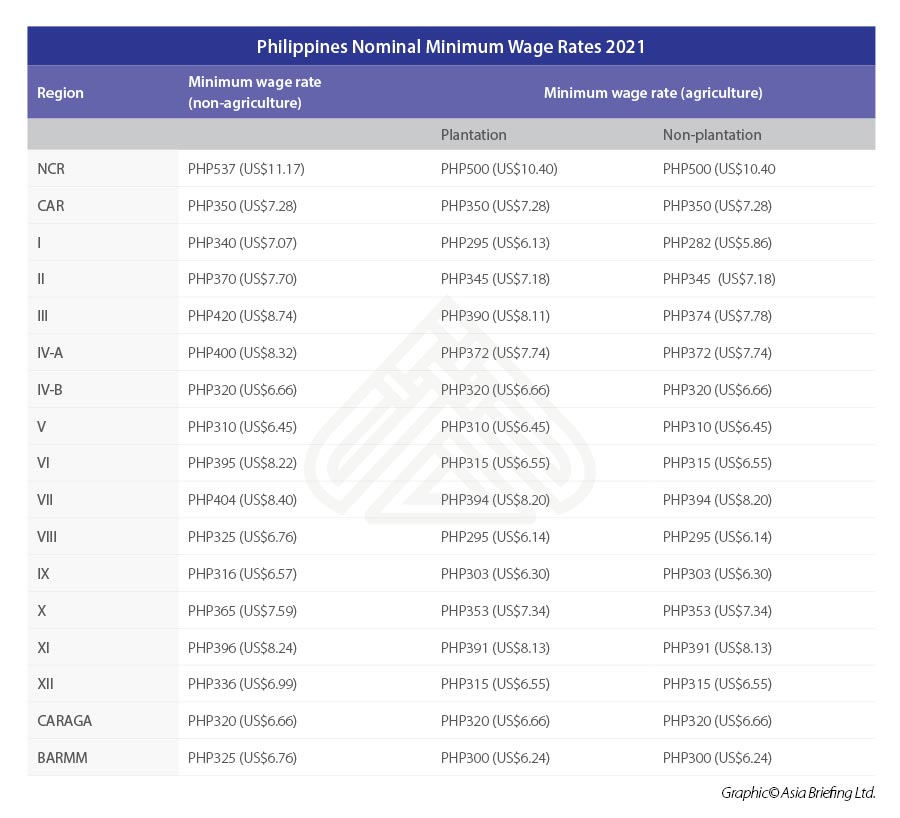

Minimum Wages In Asean For 2021

Payroll Malaysia Difference Between Wages And Salary Introduction Youtube

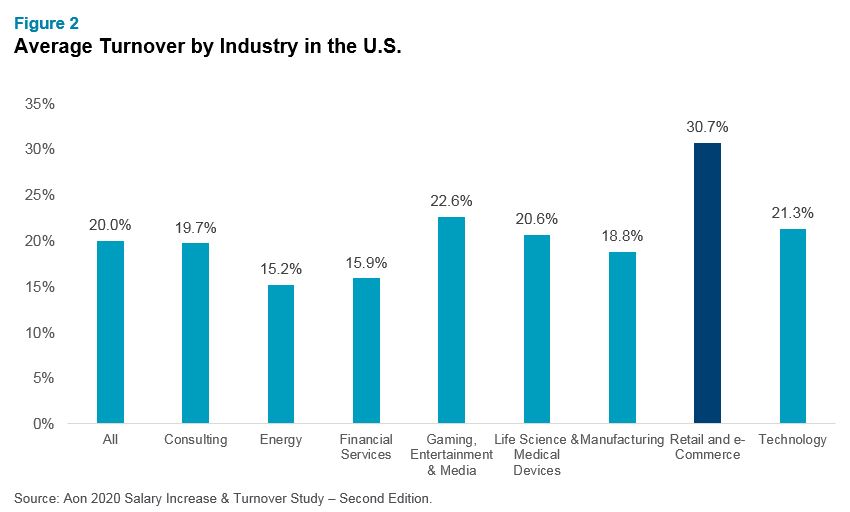

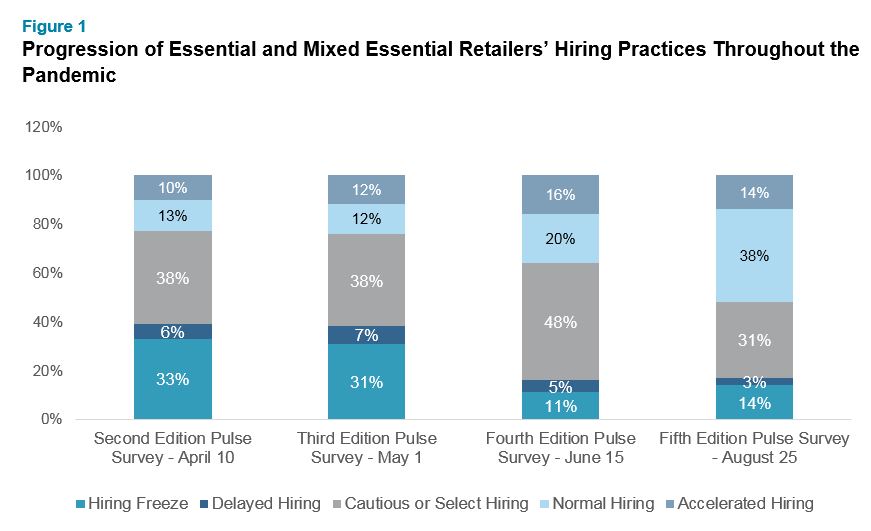

Retail Sector Wages Are Rising Due To Higher Employee Turnover And E Commerce Demand

Employee Compensation Salary Wages Incentives Commissions Entrepreneur S Toolkit

Blue Collar Workers Likely To See 10 20 Wage Hike Blue Collar Worker Worker Blue

Retail Sector Wages Are Rising Due To Higher Employee Turnover And E Commerce Demand

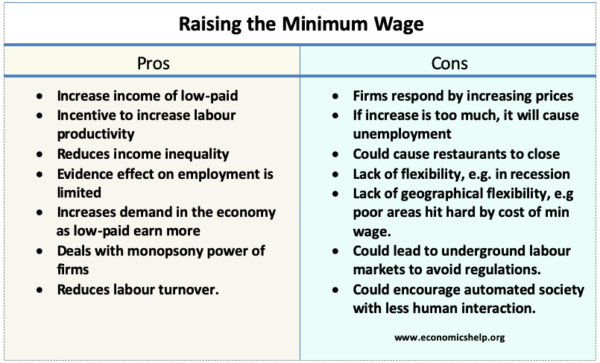

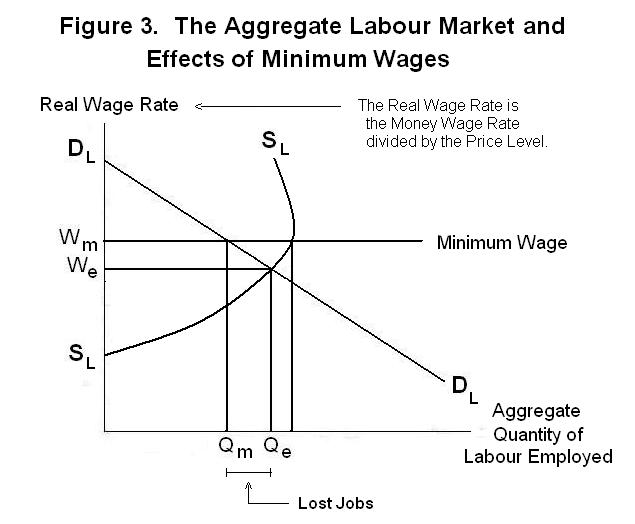

5 Reasons Raising The Minimum Wage Is Bad Public Policy

Employment Law New Minimum Wage Rates To Take Effect On 1 February 2020 Lexology

Purpose Of Minimum Wage Explained Labor Law Education Center Learn About Labor Laws In Your State Education Center Labor Law Minimum Wage

Pros And Cons Of Raising The Minimum Wage Economics Help

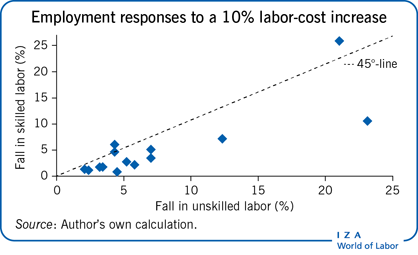

Iza World Of Labor Do Labor Costs Affect Companies Demand For Labor

Employment Act 1955 Malaysia Employment Acting Malaysia

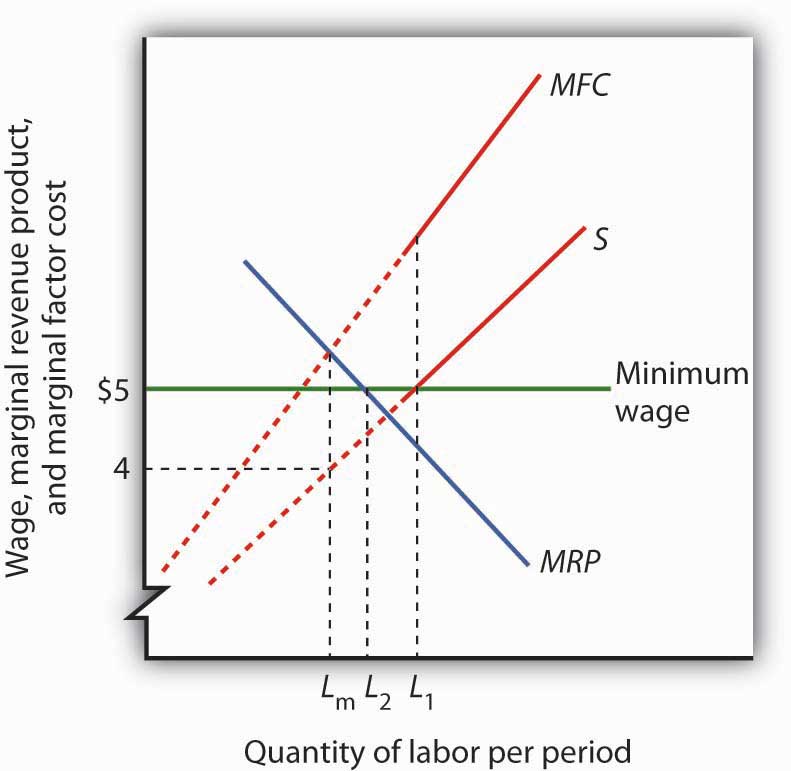

14 2 Monopsony And The Minimum Wage Principles Of Economics

In Malaysia Female Employees Get Paid Less Than Their Male Counterparts Why Is This So And What Can We Do To Fix The Problem Half The Sky

National Minimum Wage Economics Online Economics Online

Post a Comment for "Wages Under Employment Act Malaysia"