State Of Ohio Withholding Tax Rate

However if you make between 5050 and 10100 Ohio assesses you 2964 plus 1174 percent for all amounts more than 5050. For example your retirement income is taxable at the 0587 percent rate when you make up to 5050 as of 2011.

2021 Federal State Payroll Tax Rates For Employers

The top tax rate is 917163 plus 5925 percent on all income thats more than 201800.

State of ohio withholding tax rate. Ohio Federal and State Income Tax Rate Ohio Tax Rate Ohio tax tables Ohio tax withholding Ohio tax tables 2020. With rare exception employers that do business in Ohio are responsible for withholding Ohio individual income tax from their employees pay. Unlike the Federal Income Tax Ohios state income tax does not provide couples filing jointly with expanded income tax brackets.

These reductions are the first change in state withholding rates since 2015. Ohio State Payroll Taxes Ohio payroll taxes can be a little hard to keep track of. PRODUCT DOWNLOAD PURCHASE SUPPORT DEALS ONLINE CART.

The rate is at least 35 percent. An employers filing frequency for state income tax withholding is determined each calendar year by the combined amount of state and school district taxes that were withheld or required to be withheld during the 12-month period ending June 30 of the preceding calendar year ie total state and school district income tax withheld for 7119. If the employer is unsure of their filing frequency they may contact the Ohio Department of Taxation at 1-888-405-4039 for verification.

Tax Withholding Table Divide the annual Ohio income tax withholding by the number of pay dates in the tax year to determine the pay period gross tax amount. Ohio collects a state income tax at a maximum marginal tax rate of spread across tax brackets. The Finder is a service offered by the Office of Information Technology OITDepartment of Administrative Services.

Tax Withholding Tables - Percentage Method. Ohio employer ohio it 4. Annual Report PDF This excerpt from the Ohio Department of Taxations Fiscal Year 2019 Annual Report offers a summary of the municipal income tax.

Cscohiogov Tax Rates Only. They come as a result of a 63 state income tax cut HB. 64 approved in 2015 that was not structured at the time to reduce withholding rates to match cuts in the tax rate.

ODT Taxpayer Services 1-888-405-4039 or -- email. As mentioned above Ohio state income tax rates range from 0 to 4797 across six brackets. 41 Our company received a letter.

If you have questions or concerns about information listed on The Finder please contact. Ohio employers also have the responsibility to withhold school district income tax from the pay of employees who reside in a school district. Multiply the pay period gross tax by 1032 to obtain the biweekly Ohio income tax withholding.

After selecting this link click on the Tax Municipalities tab to look up rates and local points of contact for cities and villages that have enacted an income tax. January 1 2020 through December 31 2021. 8 I live outside of Ohio and won a prize in the Ohio Lottery and Ohio income tax was.

The same brackets apply to all taxpayers regardless of filing status. Heres a breakout of the various tax brackets courtesy of the Ohio Department of Taxation. 2021 State Of Ohio Withholding Tables Excel Homes Details.

Employer Withholding - Ohio Department of Taxation. Tax Withholding Tables - Optional Computer Method. You find that this amount of 2020 falls in the At least 2000 but less than 2025 range.

March 31 2020. Ohio Administrative Code 5703-7-10 provides that withholding agents must withhold at least 35 on supplemental compensation such as bonuses commissions and other nonrecurring types of payments other than salaries and wages. It includes several changes like the tax bracket changes and the tax level annually combined with the option to use a computational bridge.

2 days ago The employer must file their school district withholding returns according to their filing frequency. Income tax rates range from 0 to 4797 with varying tax brackets. The Ohio State State Tax calculator is updated to include the latest State tax rates for 20212022 tax year and will be update to the 20222023 State Tax Tables once fully published as published by the various States.

March 31 2020. Because Ohio collects a state income tax your employer will withhold money from your paycheck for that tax as well. Federal Withholding Tables 2021 As with every other prior year the freshly adjusted Ohio Employer Withholding Tax Tables 2021 was introduced by IRS to make for this particular years tax time of year.

OIT Service Desk 614-644-6860 or 877-644-6860 or -- email. The Ohio State State Tax calculator is updated to include the latest Federal tax rates for 2015-16 tax year as published by the IRS. Now use the 2021 income tax withholding tables to find which bracket 2020 falls under for a single worker who is paid biweekly.

WEEKLY and the wages are and the number of withholding exemptions claimed is more than but not over the amount of income tax to be withheld shall be --. Ohios maximum marginal income tax rate is the 1st highest in the United States ranking directly below Ohios You can learn more about how the Ohio income tax.

The States With The Highest Capital Gains Tax Rates The Motley Fool

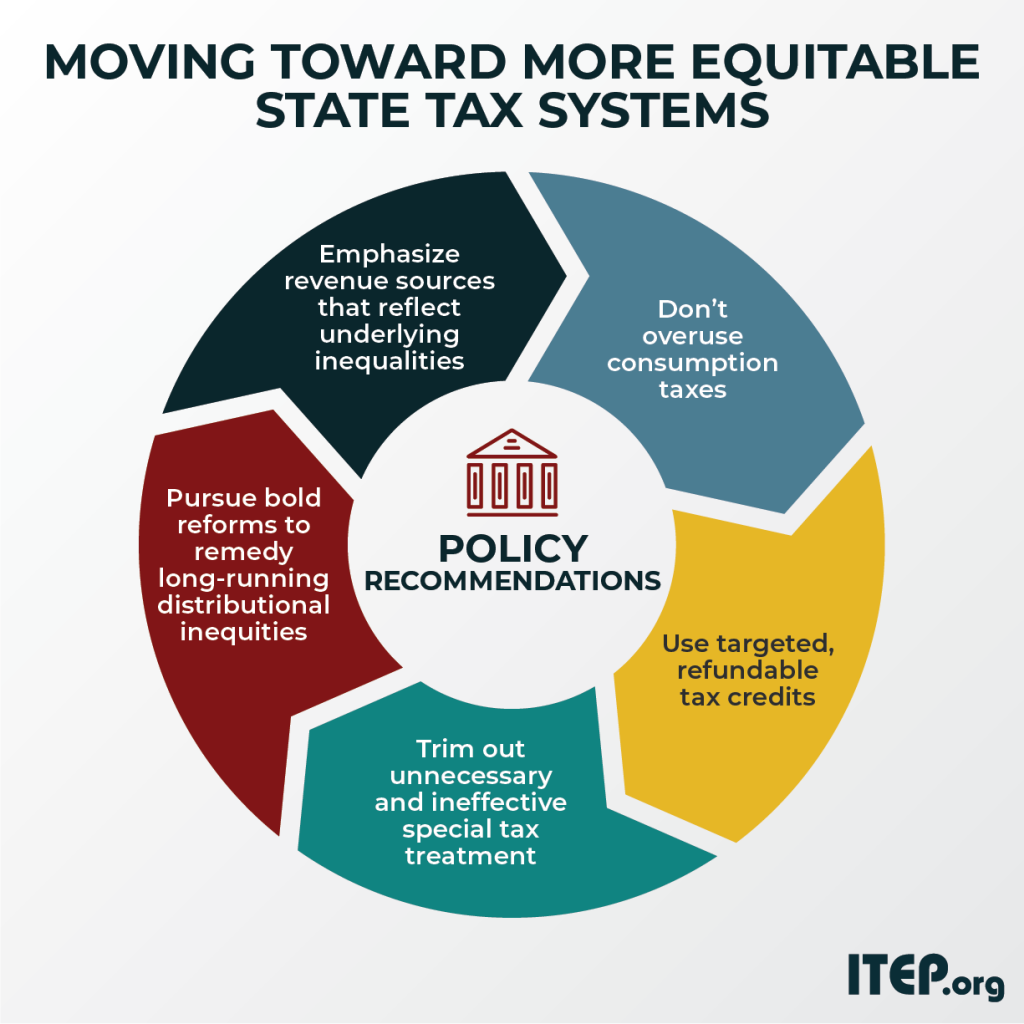

Who Pays Taxes In America In 2019 Itep

Business State Tax Obligations 6 Types Of State Taxes

States With Highest And Lowest Sales Tax Rates

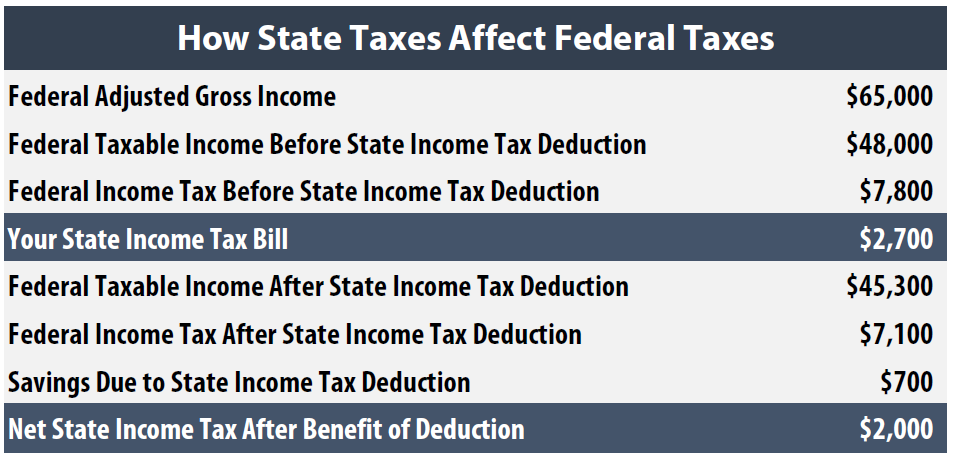

How State Tax Changes Affect Your Federal Taxes A Primer On The Federal Offset Itep

State W 4 Form Detailed Withholding Forms By State Chart

How High Are Capital Gains Taxes In Your State Tax Foundation

Corporate Tax Rates By State Where To Start A Business

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

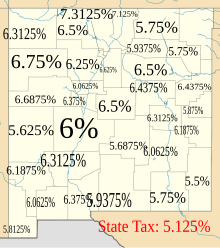

Taxation In New Mexico Wikipedia

Taxation Of Social Security Benefits Mn House Research

State W 4 Form Detailed Withholding Forms By State Chart

States With Highest And Lowest Sales Tax Rates

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)

Post a Comment for "State Of Ohio Withholding Tax Rate"