What Is The Ohio Unemployment Tax Rate

Ohios unemployment taxable wage base will remain at 9000 for 2021. 52 rijen Your tax rate might be based on factors like your industry how many former.

Ohio S Unemployment Rates By County Ohio Manufacturers Association

Unemployment tax rates for experienced employers are to range from 03 percent to 92 percent Effective Jan.

What is the ohio unemployment tax rate. Act by December 31 to potentially lower tax rates The Ohio 2020 state unemployment insurance SUI tax rates will range from 03 to 94 up from the 2019 range of 03 to 92. Ohio local income taxes which are referred to unofficially as the RITA Tax range from 05 to 275. You must register for a UI tax account as soon as you employ at least one person who is covered by Ohios unemployment compensation law.

The primary purpose of the mutualized account is to maintain the Unemployment Insurance Trust Fund at a safe level and recover the costs of unemployment benefits that are not chargeable to individual employers. The taxable wage base may change from year to year. The taxable wage base for calendar year 2020 and subsequent years is 9000.

Employers state unemployment tax rates are based largely on their experience rating which is a measure of how much they have paid in taxes and been charged in benefits. 1 2021 the mutualized tax rate is to be 05 and is to be added to experienced employers unemployment tax rates the department said on its website. Ohio collects a state income tax at a maximum marginal tax rate of spread across tax brackets.

For calendar year 2021 the mutualized tax rate will be 05. Though FUTA tax is a payroll tax it is different from the FICA taxes in the sense that only the employer contributes toward the FUTA taxes. Please note that as of 2016 taxable business income is taxed at a flat rate of 3.

The 2020 SUI taxable wage base reverts to 9000 down from 9500 for 2018 and 2019. Ohio Income Tax Update. SUI tax rates range from 03 to 90.

Specifically federal tax changes related. Ohios maximum marginal income tax rate is the 1st highest in the United States ranking directly below Ohios You can learn more about how the Ohio income tax. When completing the Quarterly Tax Return JFS-20125 please use a tentative contribution rate of 27.

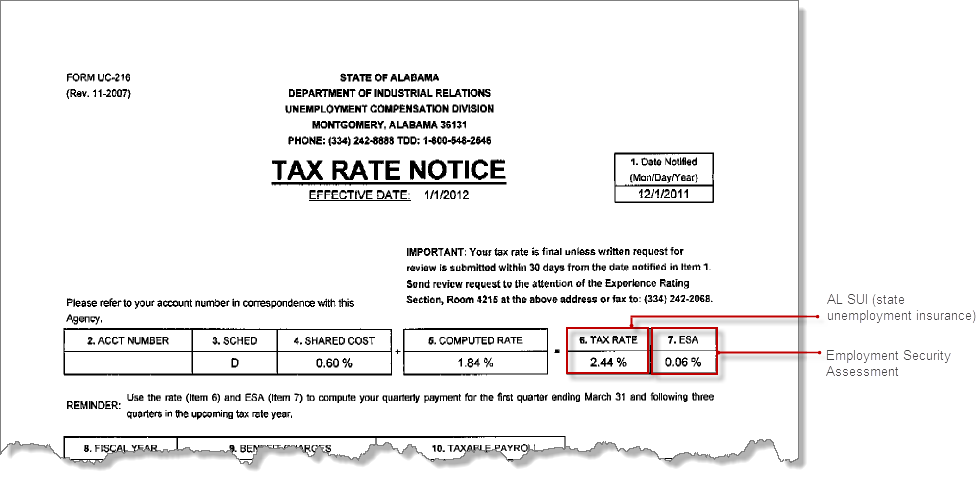

Federal Unemployment Tax Act FUTA taxes funds the unemployment insurance and job service program available in each state. You will receive written notification of your entitlement and this notification is usually provided within a few days of your filing. Ohio State Unemployment Insurance SUI As an employer youre responsible for paying SUI remember if you pay your state SUI in full and on time you get a 90 tax credit on FUTA.

If an employers account is not eligible for an experience rating it will be assigned a standard new employer rate of 27 percent. Unemployment taxes contributions must be paid on the first 9000 of an employees wages per year. 1 2019 Ohios unemployment-taxable wage base is to be 9500 unchanged from 2018 the state Department of Job and Family Services said Nov.

The federal government applies a standard 6 FUTA tax rate across industries and it does not change based on how many former employees file for unemployment benefits. New employers in the construction industry are to be assessed a rate of 580 in 2021 also unchanged from 2020. Employers however will not pay the additional 06 mutualized surcharge that applied in 2017.

As an Ohio employer subject to UI tax your small business must establish a UI tax account with the Ohio Department of Job and Family Services JFS. Taxpayers with 22150 or less of income are not subject to income tax for 2020. The following are the Ohio individual income tax tables for 2005 through 2020.

Ohio unemployment tax rates are to increase for 2021 because a mutualized tax is to be in effect the state Department of Job and Family Services said Nov. Ohio 2020 SUI tax rates increase taxable wage base decreases. Unlike the Federal Income Tax Ohios state income tax does not provide couples filing jointly with expanded income tax brackets.

5 on its website. 18 which incorporates recent federal tax changes into Ohio law effective immediately. The taxable wage base for calendar years 2018 and 2019 is 9500.

Changes in how Unemployment Benefits are taxed for Tax Year 2020. On March 31 2021 Governor DeWine signed into law Sub. When a contribution rate is officially determined for your enterprise you will be notified by mail.

The Ohio 2018 state unemployment insurance SUI tax rates will range from 03 to 90 up from the 2017 range of 03 to 88 many brackets remained the same while others increased by 01-02. The funds provide compensation for workers who lose their jobs. The new-employer tax rate is to be 270 for 2021 unchanged from 2020.

The tax brackets have been indexed for inflation per Ohio Revised Code section 574702. Ohio Unemployment Insurance BENEFITS CHART - 2021 If your application for unemployment benefits is allowed your actual weekly benefit amount will be determined after you certify your application.

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

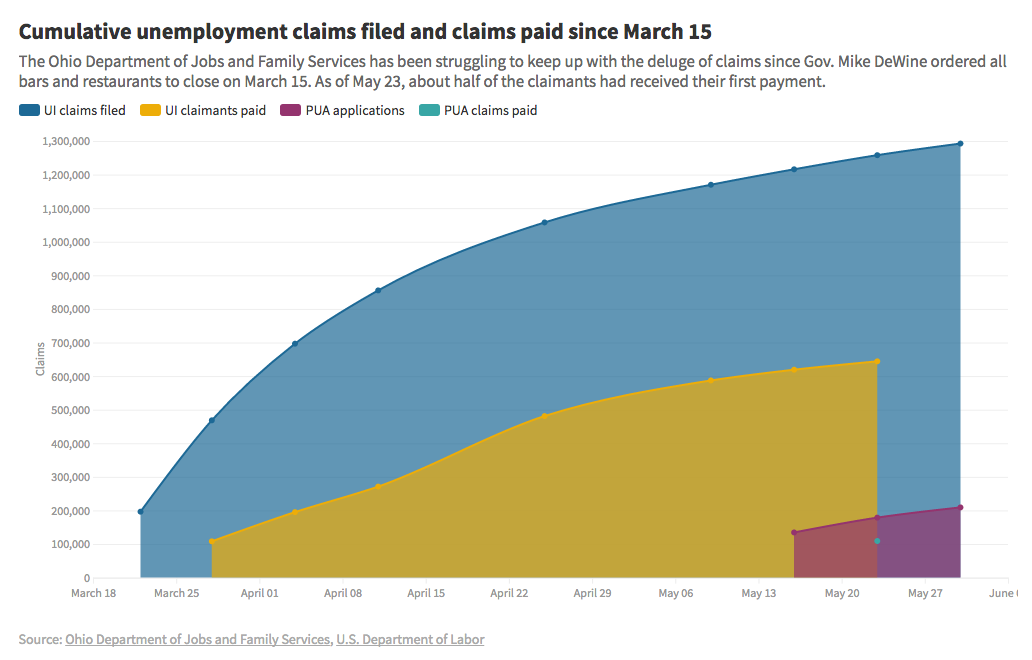

How Ohio Has Underfunded Unemployment Compensation

How Ohio Has Underfunded Unemployment Compensation

Income School District Tax Department Of Taxation

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

How Ohio Has Underfunded Unemployment Compensation

10 200 Unemployment Tax Break 13 States Aren T Giving The Waiver

How Ohio Has Underfunded Unemployment Compensation

How Ohio Has Underfunded Unemployment Compensation

Tens Of Thousands Of Ohioans Told To Repay Unemployment Benefits Scene And Heard Scene S News Blog

Unemployment Benefits Comparison By State Fileunemployment Org

How Ohio Has Underfunded Unemployment Compensation

Unemployment Fraud Chicago Man Receives Ohio Unemployment Tax Form Despite Never Living There Abc7 Chicago

Ohio Unemployment Information Benefits Eligibility Etc Aboutunemployment Org

Post a Comment for "What Is The Ohio Unemployment Tax Rate"